Many investors hold bonds or bond funds as part of a diversified portfolio. Bonds can be used to reduce portfolio volatility while providing a reliable stream of income. Given the current economic environment–near zero interest rates and persistent speculation about when and by how much they rise–the risks taken in the fixed income arena are an appropriate subject to review.

Bonds or fixed income securities are relatively simple instruments to understand. They are purchased with a fixed yield (usually but not always), pay a regular coupon, and return the principal to the owner at maturity. Thus they have the perception of safety. However, there is a price to pay for the safety that fixed income assets provide: lower expected real returns (relative to stocks).

Low real returns challenge the meaning of the word safety in the context of fixed income. Fixed income works to preserve capital in the short-term, but can be extremely risky when used to improve purchasing power over the long-term. The returns generated usually don’t provide much after inflation is accounted for. According to financial advisor Nick Murray

All debt securities are the planned liquidation of purchasing power [1]

The primary reason most investors own fixed income securities (bonds) is their ability to limit declines in portfolio value during periods of poor stock performance. From this perspective there is another dimension to safety in the fixed income universe that needs to be understood. A simple way to demonstrate this is to examine what happened during the recent global financial crisis.

| Asset | Symbol | Drawdown | 2008 Return |

| S&P 500 | – | -37.66% | -36.99% |

| Short-Term Treasuries | VFISX | – | 6.68% |

| Intermediate-Term Treasuries | VFITX | – | 13.32% |

| Long-Term Treasuries | VUSTX | -0.03% | 22.51% |

| Short-Term Tax Exempt | VWSTX | – | 3.85% |

| Long-Term Tax Exempt | VWLTX | -5.62% | -4.47% |

| Short-Term Investment Grade Corp. | VFSTX | -5.67% | -4.59% |

| Long-Term Investment Grade Corp. | VWESX | -15.97% | 2.82% |

| High-Yield Corp. | VWEHX | -27.43% | -21.29% |

| Total Bond Market | VBMFX | -1.54% | 5.43% |

| Inflation Protected Securities | VIPSX | -7.85% | -2.85% |

| Data Source: Morningstar | |||

Almost all of the non-Treasury securities experienced a drawdown during 2008 which peaked around October and November. Investors holding corporate bonds, intermediate and longer term municipal issues, and inflation protected securities were no doubt disappointed that their supposedly safe assets posted losses. Corporate bonds in particular have the unfortunate stigma of behaving like stocks during crises. Adding insult to injury those disappointed investors were also faced with taking a haircut on their fixed income returns if they wanted to rebalance and purchase equities at very low prices. Thus there is more to risk than the more academic standard deviation (volatility) of returns.

Based on this scenario Treasuries in general would appear to be the safest form of fixed income. They produced positive returns when stocks tanked–that is they became negatively correlated with stocks precisely when it mattered. Treasuries also enjoy almost no credit risk as they are backed by the full faith and credit of the United States*. One could argue convincingly that Treasury Bills should be regarded as the only safe asset. The 30 day issue features exceptionally low volatility, limited interest rate risk, but again very little in the way of real return.

| Annualized Return |

Annualized Real Return |

Volatility | |

| 30-Day Treasury (Bills) | 3.46% | 0.51% | 0.88% |

| Intermediate-Term Treasuries (Notes) | 5.25% | 2.25% | 4.38% |

| Long-Term Treasuries (Bonds) | 5.66% | 2.64% | 8.38% |

| See Notes below | |||

Treasuries bonds have the highest level of volatility, and 2008 demonstrated they also have performed best when the world appears to be coming to an end. Could a case be made to include these longer-term issues in a portfolio? Rowland and Lawson examined the use of Treasury bonds in Harry Browne’s permanent portfolio and argued that they can help defend against severe losses by providing security in times of crisis. [2] David Swensen also promoted the use of Treasury bonds in his book Unconventional Success stating “U.S. Treasury bonds provide a unique form of portfolio diversification, serving as a hedge against financial accidents and unanticipated deflation.” [3]

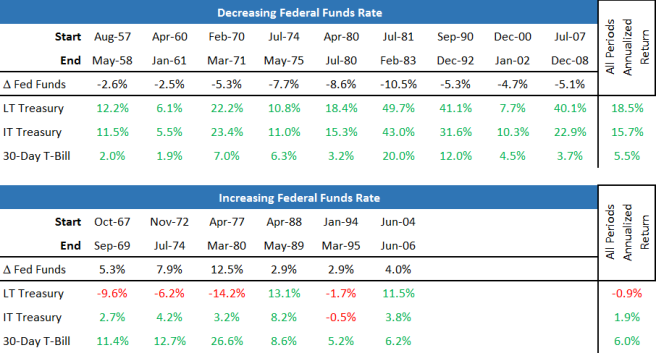

Indeed this “hedge against financial accidents,” a result of the so called flight to safety behavior, has occurred repeatedly during the past century. History has shown that the Federal Reserve tends to reduce interest rates (Federal Funds Rate) during recessionary environments through open market operations as a means to stimulate economic activity. Treasury prices (or more broadly fixed income prices) will consequently rise as price is inversely related to yield.

From this analysis it’s quite clear that the performance of Treasury bonds has been closely tied to the actions of the FOMC. Notes also took a hit during rising rate environments, but historically have had much less downside. Bills have proven to be incredibly stable and have consistently provided positive returns over every period regardless of interest rate policy.

On the volatility front I examined a more traditional 60/40 portfolio composed of 60% US large cap stocks and 40% Treasury bonds which was rebalanced annually. I then built portfolios using notes and bills, but solved for the allocation necessary to produce volatility equivalent to the 60/40 portfolio.

| Stocks/Bills | Stocks/Notes | Stocks/Bonds | |

| Stock Allocation | 63.0% | 62.6% | 60.0% |

| Treasury Allocation | 37.0% | 37.4% | 40.0% |

| Annualized Return | 8.13% | 8.81% | 8.92% |

| Volatility | 12.74% | 12.74% | 12.74% |

| See Notes below | |||

A somewhat obvious result. Treasury notes and bills provided lower returns. However, the notes option was only 11 basis points lower and with less sensitivity to changes in interest rates. Now consider a more risk averse portfolio that shuns volatility by holding 75% bills and only 25% stock.

| Stocks/Bills | Stocks/Notes | Stocks/Bonds | |

| Stock Allocation | 25.0% | 12.8% | – |

| Treasury Allocation | 75.0% | 87.2% | – |

| Annualized Return | 5.50% | 6.11% | – |

| Volatility | 5.52% | 5.52% | – |

| See Notes below | |||

The 25/75 stock/bills portfolio experienced a 5.52% standard deviation, which was achievable with notes, but not so with the higher volatility of bonds. This is an important point for risk averse investors as bonds are likely to limit the minimum volatility that is achievable in a diversified portfolio.

While there is a valid argument for holding Treasury bonds to guard against financial unrest it’s important to understand that they have experienced higher volatility at the behest of the Federal Reserve. Notes have historically provided similar but slightly lower returns compared to bonds both on their own and when tempered with stocks as part of a portfolio. However, they have the additional benefits of lower volatility and less interest rate sensitivity. The extreme stability of Treasury bills are for those who can’t stomach volatility. Consequently these individuals are also likely to experience lower returns.

References

1. Ritholtz, Barry. Financial Advisor Nick Murray: Masters in Business. Bloomberg View. 2015. https://soundcloud.com/bloombergview/financial-advisor-nick-murray

2. Rowland, Craig and J.M. Lawson. The Permanent Portfolio. John Wiley & Sons. Hoboken, NJ. 2012. pp. 87-93.

3. Swensen, David F. Unconventional Success. Free Press. New York, NY. 2005. pp. 48-54.

Notes

Recession Dates (NBER): http://www.nber.org/cycles/cyclesmain.html

Federal Funds Data (FRED): https://research.stlouisfed.org/fred2/series/FEDFUNDS

*The United States temporarily defaulted on some Treasury Bill issues in April and May of 1979. Eventually Treasury did pay these obligations: http://www.forbes.com/sites/beltway/2013/10/08/actually-the-united-states-has-defaulted-before/

Treasuries Data

Sample period is 1927-2014

Returns data is taken from the 2013 SBBI Classic Yearbook for returns through 2012. Treasury bills from 2012 through present are from the Ken French Data Library. Notes and bonds from 2012 through 2014 are the total returns of the appropriate Vanguard funds (VFITX and VUSTX respectively).

Intermediate-term (notes) maturity ≅ 5 years

Long-term (bonds) maturity ≅ 20 years

What I’m Reading

The Benefits of Getting an Icy Start to the Day (Carl Richards)

podcast: Brilliant vs. Boring (Planet Money)

The progress of science (and ourselves) (James Osborne)

Index investing: micro-efficient and macro-inefficient? (Tadas Viskanta)