Good businesses, by definition, earn more than they spend. Those that can’t or don’t simply cease to exist. A quick glance at any corporate balance sheet reveals a wide ranging list of liabilities including: wages and salaries, accounts payable, employee benefits, etc. But there is an additional liability not disclosed on GAAP compliant balance sheets: the cost of capital.

Cost of capital is essentially what a company must pay it’s investors for financing its business activities. It is roughly equivalent to the return an investor should expect to receive for investing in a company.

The cost of capital concept is easily illustrated in the popular television show Shark Tank. Small businesses pitch their ideas to potential investors who are then allowed to bid on how much they want to invest. During such an exchange the investors (sharks) and business owners are looking out for their own interests: the investors want the highest return possible, while the business owners want the lowest cost of financing. Thus the negotiation may be viewed as a crude market for determining the expected return/cost of capital of the business. It is not until an agreement is reached that their interests are aligned.

Mark Cuban and friends aside, the cost of capital lends itself to some practical considerations in the world of corporate finance. First and foremost it may be used as a hurdle rate to assess investment projects. These potential pursuits, in theory, should provide a return that exceeds the cost of capital in order for the company to realize a profit. On the other hand, investors may use the cost of capital–their expected return–to assess the risk of a company. Higher expected returns being an indicator of greater risk.

Ignoring preferred shares, convertible bonds and stock options, CFOs can purchase capital from investors through one of two ways: issue debt/bonds or equity/shares. Since most companies typically use a mix the total cost of capital may be expressed as the weighted average cost of debt and equity. Therefore, the Weighted Average Cost of Capital (WACC) is calculated in the following manner

WACC = (% Debt)*(Cost of Debt) + (% Equity)*(Cost of Equity)

Calculating the cost of debt is relatively straightforward–it is simply the sum of interest paid on bonds issued and outstanding. It is factual and objective. The cost of equity, however, is more difficult, and cannot be calculated in an objective manner. Instead it must be estimated. According to a survey conducted by Graham and Harvey the CAPM is the most prevalent method used for estimating the cost of equity (73.5% of responding firms reported always or almost always using the CAPM). [1]

Cost of Equity = Risk-Free Interest Rate + Beta (Market Rate – Risk-Free Interest Rate)

As with many models there are a few problems. It requires knowledge of the future market rate of return and the future risk-free rate of return. It also fails to disclose any information regarding the time frame over which the return should expect to be realized. Famed short-seller and herald of corporate nonsense Jim Chanos offered some enlightenment in an interview with Barry Ritholtz:

But what worries me, is that corporate America, in aggregate, has pre-tax returns on captial in the mid to high teens. The long-term expected rate of the equity markets is roughly half that. And, when, corporations are embarked on massive buybacks across all industries and all companies, in effect these CEOs are buying the stock market.

So what they’re telling you then, is unequivocally, that they think that either they’re happy to earn the stock market rate of return or maybe something hopefully better…

…Or, their rate of return on the margin of any new capital project is much much lower, in fact half or less, of what is stated, and that does not bode well for the future profits or for the quality of earnings reported as current profits.

There’s one additional problem with this whole thing, and that is number one, the CEOs making this decision typically have a very short tenure at companies… …they’re not thinking long-term, and number two, we’re seeing an increase in insider selling concurrent with the increase in buybacks [2]

To summarize, capital does indeed have a cost, but attempting to forecast what it will be in the future–specifically where the cost of equity will be in the future–is equivalent to forecasting the future returns of a company or the broader market as a whole. Like so many others that have tried and failed, it would appear that the executives of major corporations don’t have a good handle on assessing their future prospects. When the long term return of US equities has been approximately 10%, it’s hard to believe that corporate America has a corresponding cost of capital of 15%, 16%, 17% or higher.

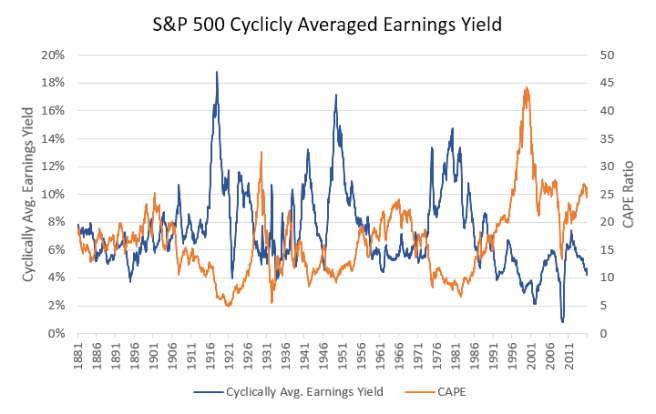

Where does this leave us? Robert Shiller has previously shown that the cyclically averaged price-earnings (CAPE) ratio has had some predictive power in forecasting expected returns. [5] If equity investors take the perspective that their ownership entitles them to a share of corporate earnings then the cyclically averaged earnings yield (inverse of the CAPE ratio) may be taken as a rough indicator of the cost of equity. At the end of 2015 the S&P 500 had a CAPE ratio of approximately 26 and a cyclically averaged earnings yield of 3.9%–fairly low by historic standards. For corporate executives this would imply that equity is relatively inexpensive, and for the investor, future returns probably won’t be great.

1. Graham, John R. and Campbell R. Harvey. The theory and practice of corporate finance: evidence from the field. Journal of Financial Economics. No. 60. 2001. pp. 187-243. https://faculty.fuqua.duke.edu/~charvey/Research/Published_Papers/P67_The_theory_and.pdf

2. Barry Ritholtz Interviews Chanos: Masters in Business. 2015. https://soundcloud.com/bloombergview/barry-ritholtz-interviews-6. (29:45 for pre-tax return on capital).

3. Gallo, Amy. A Refresher On the Cost of Capital. Harvard Business Review. April 30, 2015. https://hbr.org/2015/04/a-refresher-on-cost-of-capital

4. Mullins, David W. Does the Capital Asset Pricing Model Work? Harvard Business Review January 1982. https://hbr.org/1982/01/does-the-capital-asset-pricing-model-work

5. Shiller, Robert J. and John Y. Campbell. Valuation Ratios and the Long-Run Stock Market Outlook. The Journal of Portfolio Management. Winter 1998. pp. 11-26. http://www.econ.yale.edu/~shiller/online/jpmalt.pdf

6. Robert Shiller Irrational Exuberence Data. www.econ.yale.edu/~shiller/data/ie_data.xls.

What I’m Reading

The Three Essential Properties of the Engineering Mind-Set (Farnam Street)

What’s (Still) Wrong with Executive Compensation in America (JSTOR)

Commonsense Corporate Governance Principles (governanceprinciples.org)

An Introduction to Factor Investing: Part II (Isaac Presley)

The Trinity Portfolio (Meb Faber)

How Does This Hedge-Fund Manager Make So Much Money? (Bloomberg)